Swedish "Karensavdrag"

Background

(below is taken from Försäkringskassan's website)

"The waiting period deduction or karensavdrag, was introduced on 1 January 2019 and replaced what was previously known as the waiting period/karensdag. The purpose of the change was to make the deduction made when you are sick fair and predictable.

The waiting period deduction/karensavdrag is 20% of the sick pay that the employee receives in an average week when they are sick. Usually, the deduction is calculated by the payroll system ...... The detailed calculation of the karensavdrag can be determined by collective agreement."

A number of collective agreements have agreed on a waiting period to manage the waiting period deduction. Check what applies in your own collective agreement. Below is an example from the Retail Agreement.

Waiting period/Karensperiod

- The waiting period or karensperiod, is the first part of the sick pay period that the employee would have worked if the employee had not been sick.

- The length of the waiting period is calculated as 20% of the pre-agreed current average weekly working time.

- For the period after the waiting period until the 14th day, sick pay (including sick-UT) is paid.

Settings

A minimum of 3 connected salary types to a sickness absence reason are required in order to ensure the correctness of the waiting period deduction/karensavdrag and any cost calculations.

- Karens for the karensperiod without payroll cost and no link to sick-UT.

- Sick up to 14 days with 80% salary cost and link to sick-UT.

- Sick from day 15 with no salary cost and no link to sick-UT.

You then create the absence reason for sick leave in Account settings -> Absence settings -> Edit/Create absence type -> Save. Afterward, you may add the desired salary types.

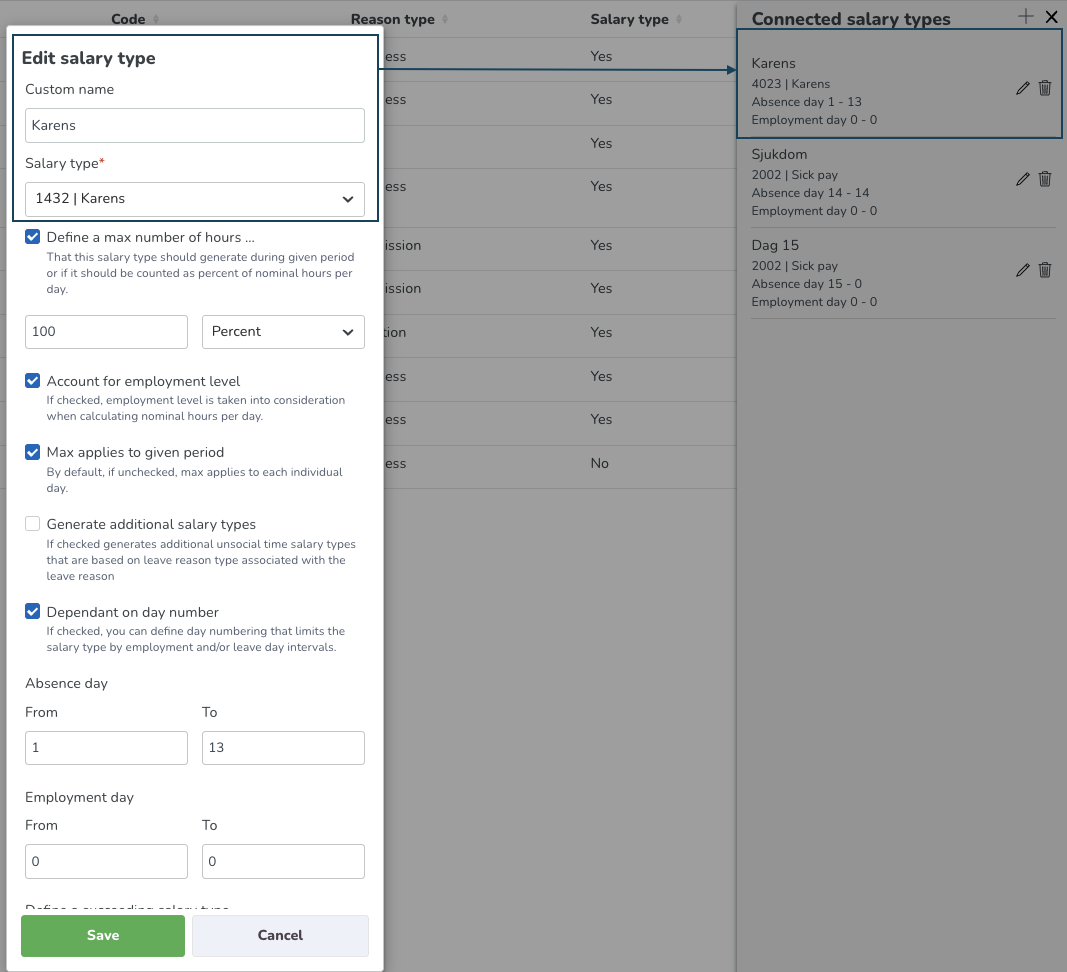

Salary type 1 - "Karens"

The setting for the Karens needs to be entered with a maximum that should correspond to 100% of a nominal day for the whole period which corresponds to 20% of the weekly working time.

The employment rate must be taken into account in order to adapt the length of an average working day for a part-time employee to the current employment rate.

To configure this, the following settings are made:

- Define a maximum number of hours: Yes (ticked) and: 100 Percent

- Calculate the employment rate: Yes (ticked)

- Maximum valid for the selected period: Yes (ticked)

- Generate additional salary types: No (not ticked)

- Depending on day numbering: Yes (ticked)

- Day of absence 1-13

- Define subsequent salary type: Salary type 2 - "Sick up to 14 days" (specify the salary type to be generated for sick leave days 1-4)

Salary type 2 - "Sick up to 14"

Sick leave is paid by the employer for the first 14 days according to the law on sick pay. This means that in combination with the waiting period deduction/karensavdrag, we need to create another connected salary type for this to be generated after the employee has had a waiting period deduction/karensavdrag up to and including day 14. After that, another salary type should be generated when the Social Insurance Agency takes over the reimbursement obligation.

To configure this, the following settings are made:

- Define a maximum number of hours: No (not ticked)

- Generate additional salary types: Yes (ticked), this is to generate sick-UT

- Depending on day numbering: Yes (ticked)

- Absence day 14-14, the reason for day 14-14 is that we have entered 1-13 in salary type 1 - "Karens" and subsequent absence to salary type 2 - "Sick up to 14".

- Define subsequent salary type: No (leave blank)

Salary type 3 - "Sickness 15-"

As the insurance company takes over from day 15, we need to define an additional salary type here to generate the correct outcome for payroll and reporting.

To configure this it is done by entering the following settings:

- Define a maximum number of hours: No (not ticked)

- Generate additional wage types: No (not ticked)

- Depending on day numbering: Yes (ticked)

- Absence day 15-0, the reason for day 0 is that it counts indefinitely if not defined.

- Define subsequent salary type: No (leave blank)